With our offshore accounting services, CPA firms can enhance their teams and capabilities, focusing on growth and client service excellence. Our Outsourced Accounting Services, which cover bookkeeping, financial statements, tax compliance, and more, offer CPA firms cost-effective solutions when outsourcing accounting services. Our expertise ensures accuracy and compliance, allowing you to achieve your business goals with confidence. Your choice of an offshore accounting service provider should not just be based on your current needs but also on future requirements. As your tech business expands, your accounting needs will become more complex.

Access to a Global Talent Pool

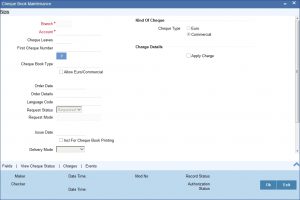

Thus, it is crucial that the offshore accounting firm you choose has the ability to scale its services in line with your growth trajectory. They should be able to seamlessly step up their services, whether it involves managing a larger volume of tasks or dealing with more complex accounting functions. The benefits of outsourcing include access to specialized expertise, increased efficiency, https://www.online-accounting.net/ improved accuracy, and greater control over finances. Offshore firms can provide a wide range of services, including general ledger, accounts payable/receivable, inventory management, stock maintenance and investment analysis. Ecommerce businesses experience high transaction volumes, deal with multiple currencies, and require sophisticated systems for tracking sales and inventory.

Improved Focus on Core Business Functions:

Safebooks Global firms specialize in providing a wide range of accounting services. Offshore accounting refers to the practice of hiring a company in a different nation to handle https://www.accountingcoaching.online/recording-depreciation-expense-for-a-partial-year/ various accounting responsibilities. This method falls under the category of outsourcing and provides significant savings as opposed to maintaining an internal accounting team.

» Challenges faced by Businesses in Accounting

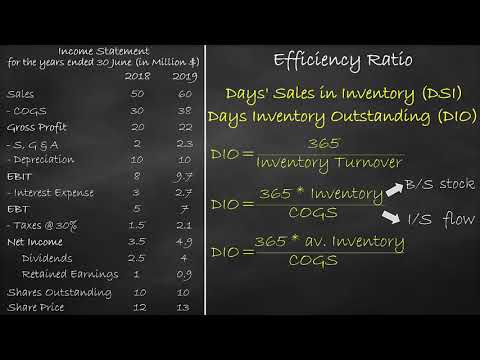

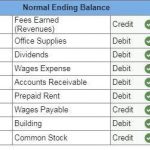

Consider going over each provider’s website to verify their business portfolio while doing this. Also, don’t forget to include other important performance indicators such as the firm’s profitability, liquidity, efficiency, valuation, and leverage in this section. You may have completed your quarterly financial report, double-checked that your inventory is up to date, or automated your payroll. Workspaces, PCs, office supplies, accounting software, and other workplace requirements like ISO are just a few things you should have on hand. For example, a firm may simply use a virtual accountant to prepare their financial statements every quarter and a few bookkeepers to maintain their books and inventories regularly.

Offshore accounting cost

However, I think offshoring has changed dramatically for the better over the years. This approach is reflected in the composition of the entire Future Firm team — we’re proudly 100% offshore. We are also flexible to work in your environment to keep your data within your system. Other than this, we also sign NDA with you as well as employees to give you surety on keeping your data private and confidential. Having the latest software could make a lot of difference in your accounting work.

This can be a cost-effective solution, especially for non-core activities such as payroll processing or accounts payable/receivable management. Quality control is essential when it comes to offshoring accounting services. Make sure that the provider has established processes in place for ensuring accuracy, timeliness, and reliability in their work product. This will help ensure that all financial information provided is up-to-date and accurate so you can provide your clients with superior service. Offshore accounting service providers offer CPAs a reliable and trustworthy option when it comes to managing their finances. By leveraging the expertise of experienced professionals, CPAs can be assured that their financial data is being carefully managed and kept secure.

- Tax preparation aids in balancing accounting books; preparing tax and financial reports, submitting a return, and much more.

- On the other hand, accounts payable (AP) is the money your business owes to sellers or vendors.

- The best offshore accounting teams are those with a solid foundation in bookkeeping and managing accounting tasks.

- Additionally, you should feel confident in your offshore accounting firm’s ability to keep your data safe.

- They providers offer a client-centric approach that allows CPAs to access the services, when they need them.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, should i expense this business vs personal expenses does not provide services to clients. It is important to recruit an offshore accounting team that can adhere to these two things and knows how to secure your data against any cyberattacks that could potentially happen.

To provide global business with world – class offshore accounting solutions,combing cutting – edge technology , export knowledge , and unparalleled service quality. In this guide, we’ll walk you through the steps to successfully offshoring your accounting services. We’ll cover everything from selecting the right offshore partner to communication strategies and managing the transition. Offshoring accounting services can be a great way to reduce costs and increase efficiency for CPA firms. However, it’s important to approach the process carefully to avoid any potential pitfalls. Offshoring your tax reporting and filling also lets you submit your returns and declare taxes accurately on time.

Ideally, the firm should be able to provide immediate assistance to prevent any hindrance to your accounting tasks. What’s the point of outsourcing if you spend just as much (or more) effort checking over work for accuracy, managing a service provider, and still paying for it? Offshore teams are often cheaper than those who work within the United States. However, there are still many factors to consider when choosing an offshore team. For example, you’ll want to look for companies that offer affordable rates while providing quality support and customer service. There are several ways to compare offshore teams to see which ones fit your budget best.

We provide accurate and timely financial reporting services to help businesses monitor their financial performance and make informed decisions. Our comprehensive financial reports provide valuable insights into key financial metrics, enabling our clients to assess their financial health and plan for the future. Our bookkeeping services are designed to accurately record and maintain financial transactions for businesses of all sizes. With our meticulous attention to detail and advanced software solutions, we ensure that our clients’ financial records are organized and up-to-date.

You should also make sure they have employee performance monitoring software in place. This provides you with correct data regarding how many hours your offshore team works daily. As your company develops, you’re bound to have an increase in work as it grows, and this may get out of control over time.

Take a look at my recommendation for the 5 best books for accounting firms looking to modernize and stay ahead of the curve. If you’re going to fully embrace offshore operations in a specific country, I highly suggest you also hire a local manager. Data security is one of the main concerns of those in the accounting industry who are skeptical about offshoring. Clients may also not be very welcoming about the idea of your firm employing accountants from different parts of the world.

And accounts payable is the amount of money you owe to a seller or a vendor. This service lets you identify and reach out to clients who haven’t paid their invoices on time. There is no alternative to your assessment; hence, it is highly recommended to interview an individual through video and online tests to check for knowledge and experience. Apart from the real-time interaction with the candidate you can also examine the body language, facial expressions, communication skills, and personality in video interviews. It helps you know the candidate better, decide who would be the best fit, and finally have the best person on the job. Not just that, it also helps you determine the potential longevity of the particular staff in your firm.